Which of the following is true about a growing annuity? This intriguing question marks the beginning of our exploration into the world of growing annuities, a captivating financial instrument that offers a unique blend of growth potential and income stability.

Growing annuities stand out from traditional annuities by providing a steadily increasing income stream, adapting to inflation’s relentless march. This dynamic characteristic makes them a compelling choice for individuals seeking financial security in an ever-changing economic landscape.

1. Overview of Growing Annuities

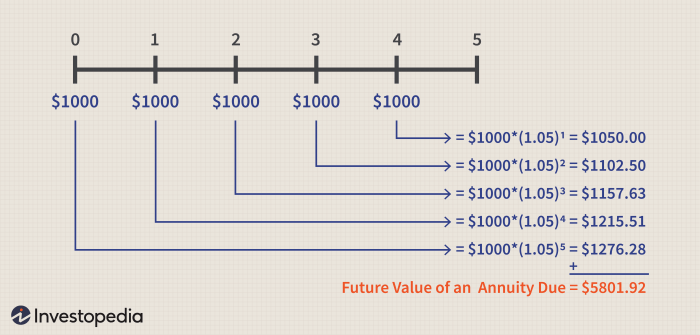

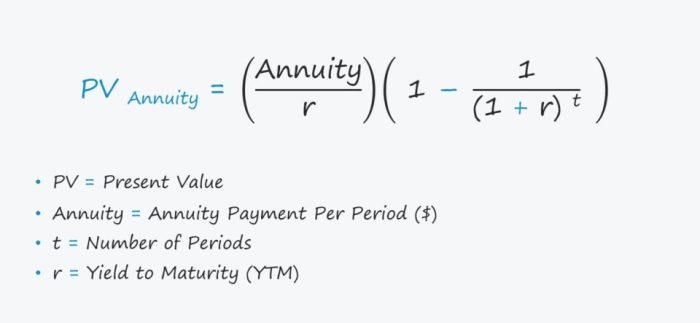

Growing annuities are a type of annuity that provides a guaranteed income stream that grows over time. Unlike traditional annuities, which pay out a fixed amount each month, growing annuities offer the potential for higher returns due to their ability to increase in value over time.

There are different types of growing annuities, including:

- Variable annuities: These annuities invest in a portfolio of stocks, bonds, or other investments. The value of the annuity fluctuates based on the performance of the underlying investments.

- Fixed indexed annuities: These annuities are linked to a specific market index, such as the S&P 500. The value of the annuity grows based on the performance of the index, but it is also protected from market downturns.

- Equity-indexed annuities: These annuities are similar to fixed indexed annuities, but they offer the potential for higher returns. However, they also come with higher risks.

2. Benefits of Growing Annuities: Which Of The Following Is True About A Growing Annuity

Investing in a growing annuity offers several advantages:

- Guaranteed income stream: Growing annuities provide a guaranteed income stream that can help you meet your retirement expenses.

- Potential for growth: Unlike traditional annuities, growing annuities offer the potential for higher returns due to their ability to increase in value over time.

- Tax benefits: Growing annuities offer tax-deferred growth, which means that you don’t have to pay taxes on the earnings until you withdraw them.

3. Considerations for Growing Annuities

When choosing a growing annuity, it is important to consider the following factors:

- Investment options: Different growing annuities offer different investment options. It is important to choose an annuity that offers investments that meet your risk tolerance and financial goals.

- Fees: Growing annuities typically come with fees, such as surrender charges and administrative fees. It is important to compare the fees of different annuities before choosing one.

- Risks: Growing annuities are subject to market risks. It is important to understand the risks involved before investing in a growing annuity.

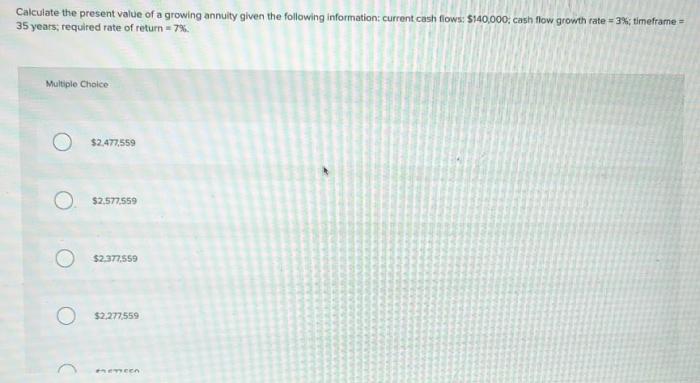

4. Growth Potential of Growing Annuities

The growth potential of a growing annuity is determined by the following factors:

- Investment performance: The growth of a growing annuity is directly related to the performance of the underlying investments.

- Market conditions: The overall market conditions can also affect the growth of a growing annuity.

- Annuity type: Different types of growing annuities have different growth potential. Variable annuities have the highest growth potential, but they also come with the highest risks.

5. Uses of Growing Annuities

Growing annuities can be used as a retirement planning tool to help you meet your retirement income needs. They can also be used for legacy planning to provide a financial legacy for your loved ones.

Here are some case studies of how growing annuities have been used to meet financial goals:

- A couple in their 60s used a growing annuity to supplement their retirement income. The annuity provided them with a guaranteed income stream that grew over time, helping them to maintain their desired lifestyle in retirement.

- A single mother used a growing annuity to save for her daughter’s college education. The annuity provided her with a tax-advantaged way to save for her daughter’s future, and it also offered the potential for growth.

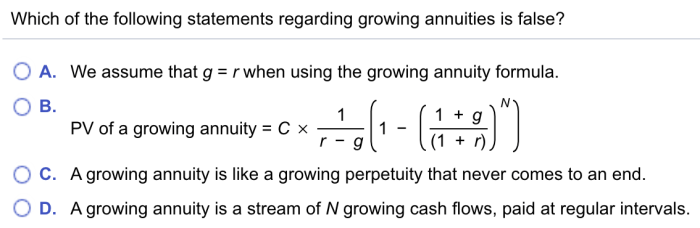

Question Bank

What is the primary advantage of a growing annuity?

Growing annuities provide a steadily increasing income stream that can outpace inflation, ensuring purchasing power is maintained over time.

How do growing annuities differ from traditional annuities?

Traditional annuities offer a fixed income stream, while growing annuities provide an income stream that grows over time, typically based on a market index or a predetermined rate.

Are there any risks associated with growing annuities?

As with any investment, growing annuities carry some risk. The primary risk is that the underlying investments may not perform as expected, resulting in lower-than-anticipated growth.